Senior Visual/Interaction Designer | CommBank | October 2014 – February 2017

Improvements to the CommBank app using animations and transitions

I was part of the CommBank app team for 2.5 years as a Senior Visual/Interaction designer.

While I worked at CommBank I tried to develop one of my biggest passions, which is motion design. I believe that animations can bring interfaces to another level when used correctly.

Most people would say banking is boring. So, to make the user’s experience with the CommBank app more interesting I incorporated several elements of motion to create elegant transitions and add a layer of delight and fun. These are some examples:

Redesigning Pay Someone

Pay Someone is the most used feature in the CommBank App. The previous design was inconsistent with the updated app look and feel, included features which weren’t used and was very static using standard native screen transitions.

I worked with a UX designer to simplify this feature, removing any clutter and making it more dynamic. Elements of motion were added to make screen transitions smoother, creating a seamless user experience, and adding an element of delight when making a payment.

A different way to pay

I worked on this feature while I was part of the Innovations Team. We were always trying to come up with creative ways to make banking more interesting for users.

Camera Pay is a fun way to pay other CommBank app users by using the phone camera to scan a unique code. We wanted the feature to be easily accessible through the main screen in the CommBank App, therefore we decided to add it as an extra item on the carousel on the dashboard.

Improving the Digital Activation feature

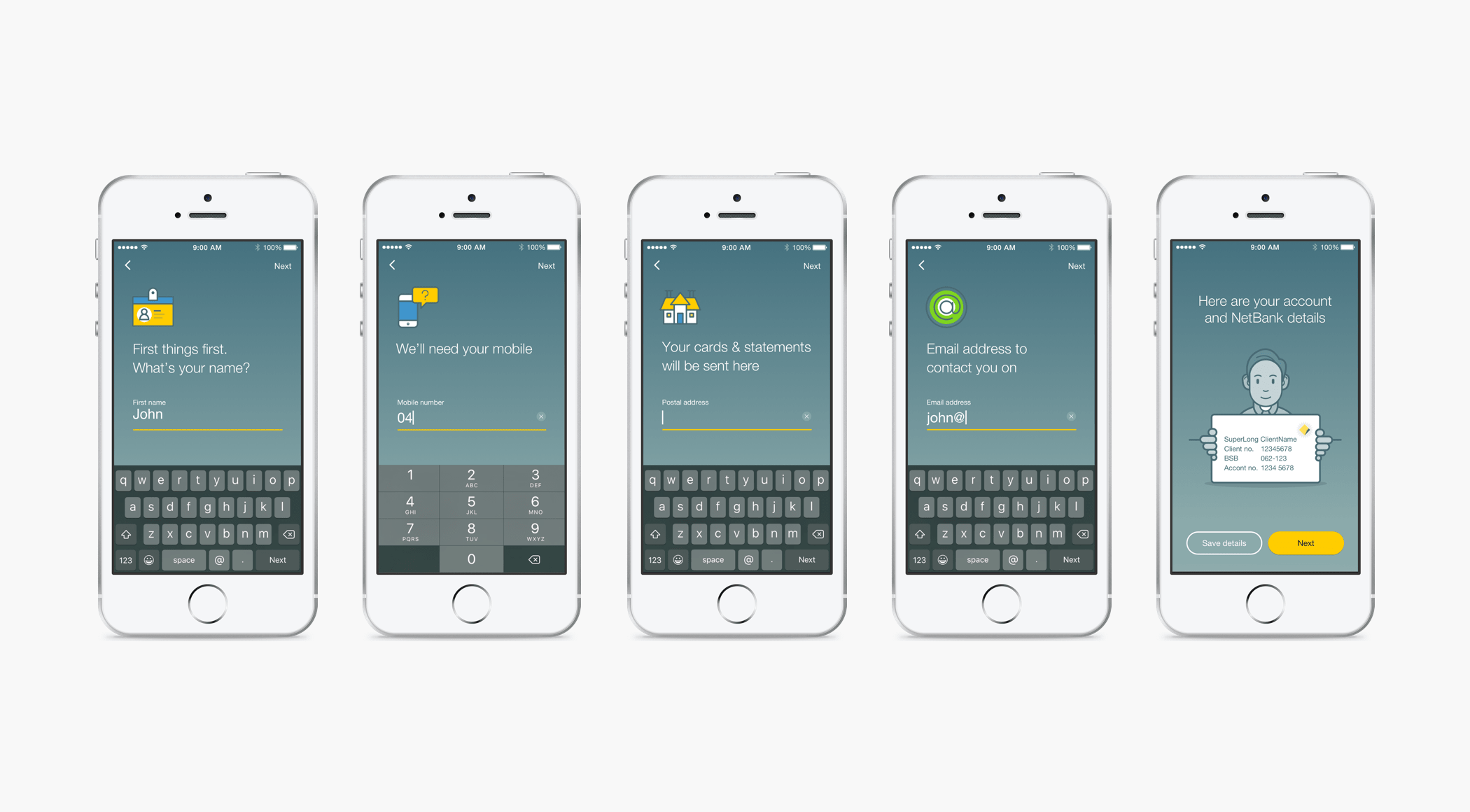

Early 2016 CommBank launched a feature in the mobile app to give anyone the ability to become a Commonwealth Bank customer by opening a new transaction account.

This feature was designed using conversational UX principles, guiding the user through a very simple and easy process to originate a new account, go through an electronic ID verification, and instantly gain access to the CommBank app and their account. After opening their account customers are also given the option to transfer money from a different financial institution using a debit card, to instantly fund their new account.

A few months into the launch of this feature it was time to look at the metrics and see if it was performing as expected, and the data showed that there were multiple issues and the drop-off rate was huge.

This feature was originally done by a different designer and I inherited it to investigate what the issues were and make improvements to the UX flow.

Some key insights from the metrics

42% of customers who start the origination process drop off when prompted to confirm

50% of customers going through the funnel are existing CBA customers who are not digitally active (this feature was designed for new to bank customers)

64% of customers failed the Electronic Customer Verification (ECV)

8% of customers going through ECV are from overseas and fail the verification process

3% of customers lie about their age

Only 6.5% of accounts go to quality

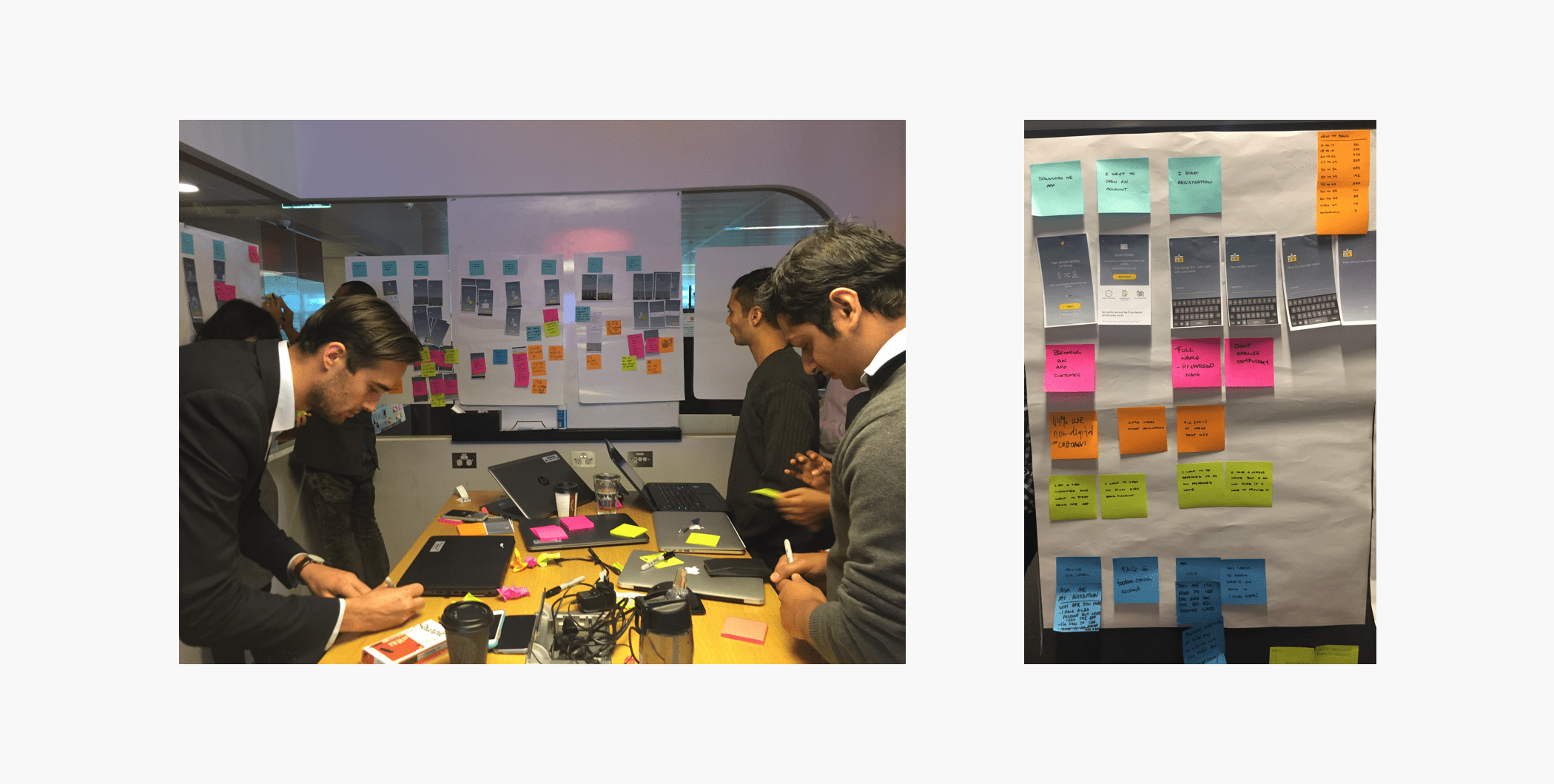

Discovery workshop with the team

I kicked off the project by running a discovery workshop with the entire scrum team (product owners, BAs and engineers). I presented the data findings and together we mapped out the entire journey on the wall, identifying where in the journey the problems were occurring, and coming up with hypothesis to validate why those issues were happening.

More research needed

We already had the data, the next step was to understand why issues were occurring throughout the journey, and why customers who opened accounts were not using them.

I worked with the UX Research team at Commbank to set up a survey and send it out to all customers who had already gone through the process of opening a new account through the app.

The survey was sent to 4,933 customers and response rate was 1% (only 107 customers responded), most likely due to the disengaged customer segment targeted.

Survey respondents were asked about their experience with opening a new account, what type of account they had opened, satisfaction with their overall experience, aspects they liked and what would like to see improved, reasons for not using their new bank account, what the bank could do to encourage customers to use their account, demographics.

Summary of findings

Existing CBA customers are looking for a way to register for the app and mistakenly open a new bank account instead.

A proportion of customers incorrectly think they have opened a savings account and as such are depositing funds only, and not using the account regularly.

Incorrectly inputted names and email addresses from the customer list data suggest the current application form may not be effective at capturing quality data.

Issues with the ECV processes may be related to bad quality data entered in the form. Users are experiencing multiple errors and are unable to troubleshoot leading to drop-off. No clear path on what to do next.

Some are not transacting on their account because they do not intend to. However, other are waiting for a trigger (first pay, travel, etc).

Satisfaction was high for those customers who went through the account origination process without any issues. 72% of were extremely satisfied.

Solutions

Based on the survey findings, multiple areas with opportunities for improvements were identified, and these are some of the solutions I was able to come up with.

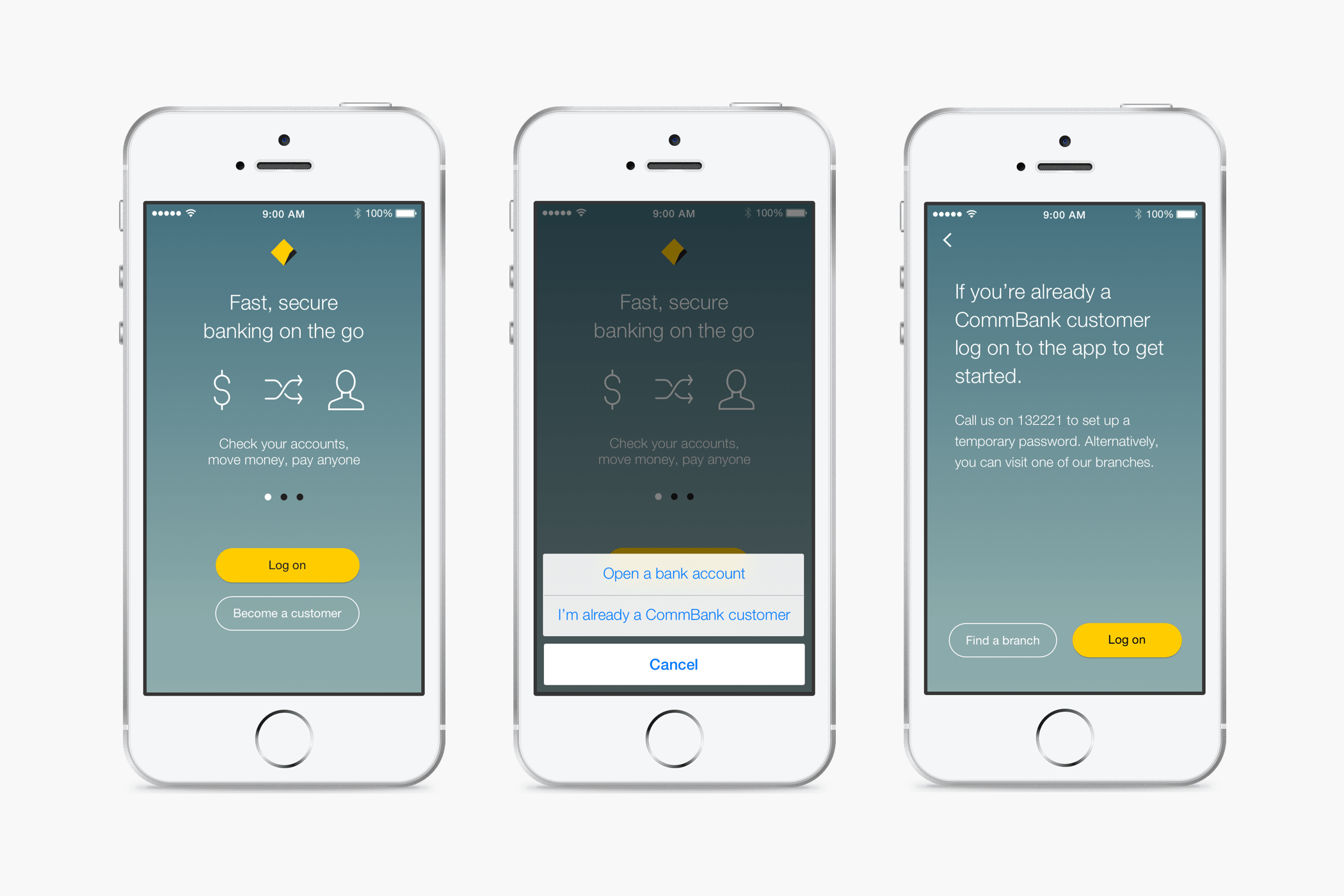

Filtering existing & potential customers down the right funnel

I made some small changes to the app welcome screen, by adding an extra step when customers tap “Become a customer”, leading them to the right path and giving existing CBA customers instructions on how to log in to the app.

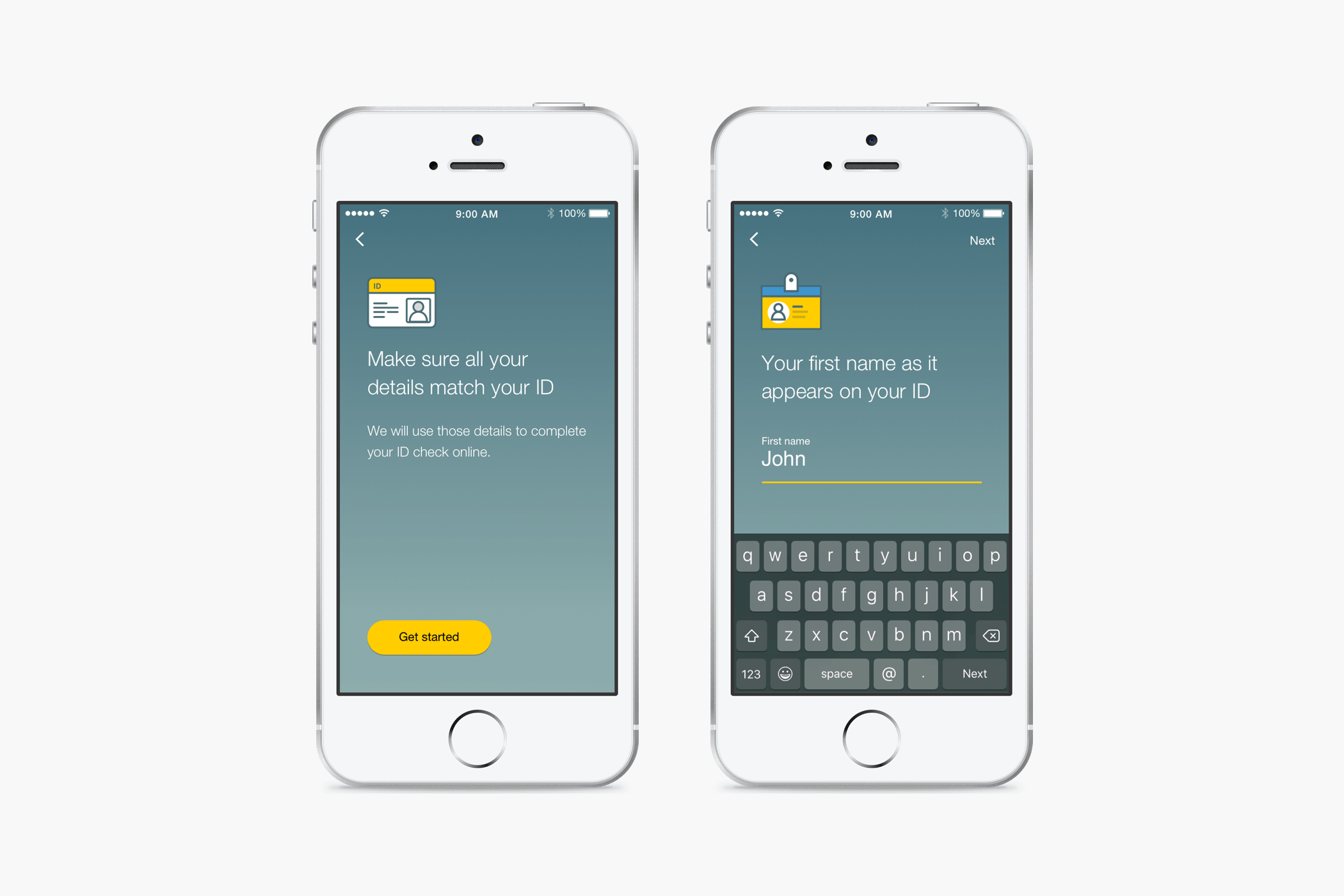

Capturing quality customer data in the correct format, and exploring ways to minimise ECV failure or provide alternate methods of verification

I added an instruction screen at the very start of the flow to advise customers to make sure the details they entered on the form match what’s on their ID. I also adjusted the copy on the entry form to reinforce that.

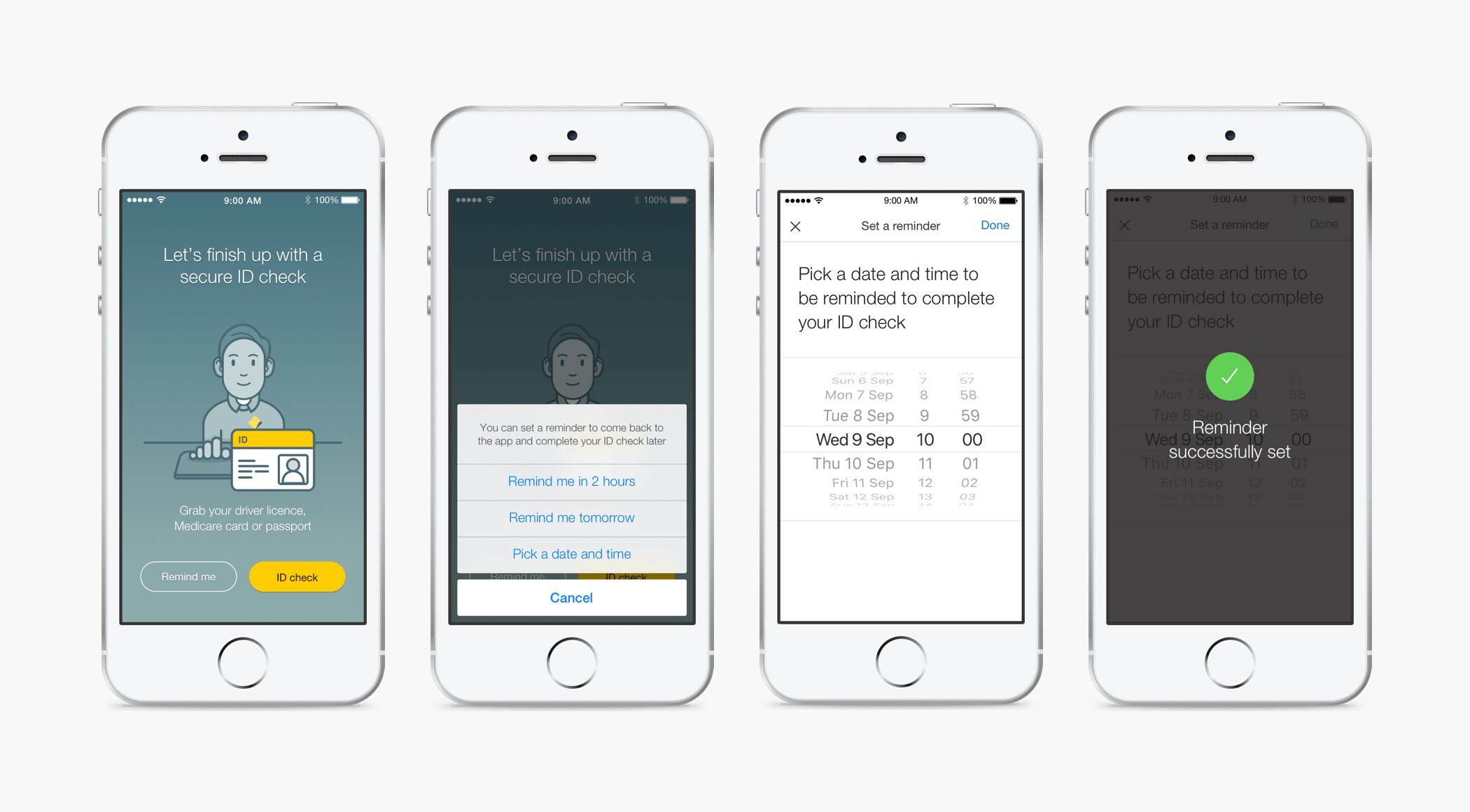

I also added an option for customers to set up a reminder on their phones to complete their ID check later. They are then sent a push notification which takes them back to the correct screen.

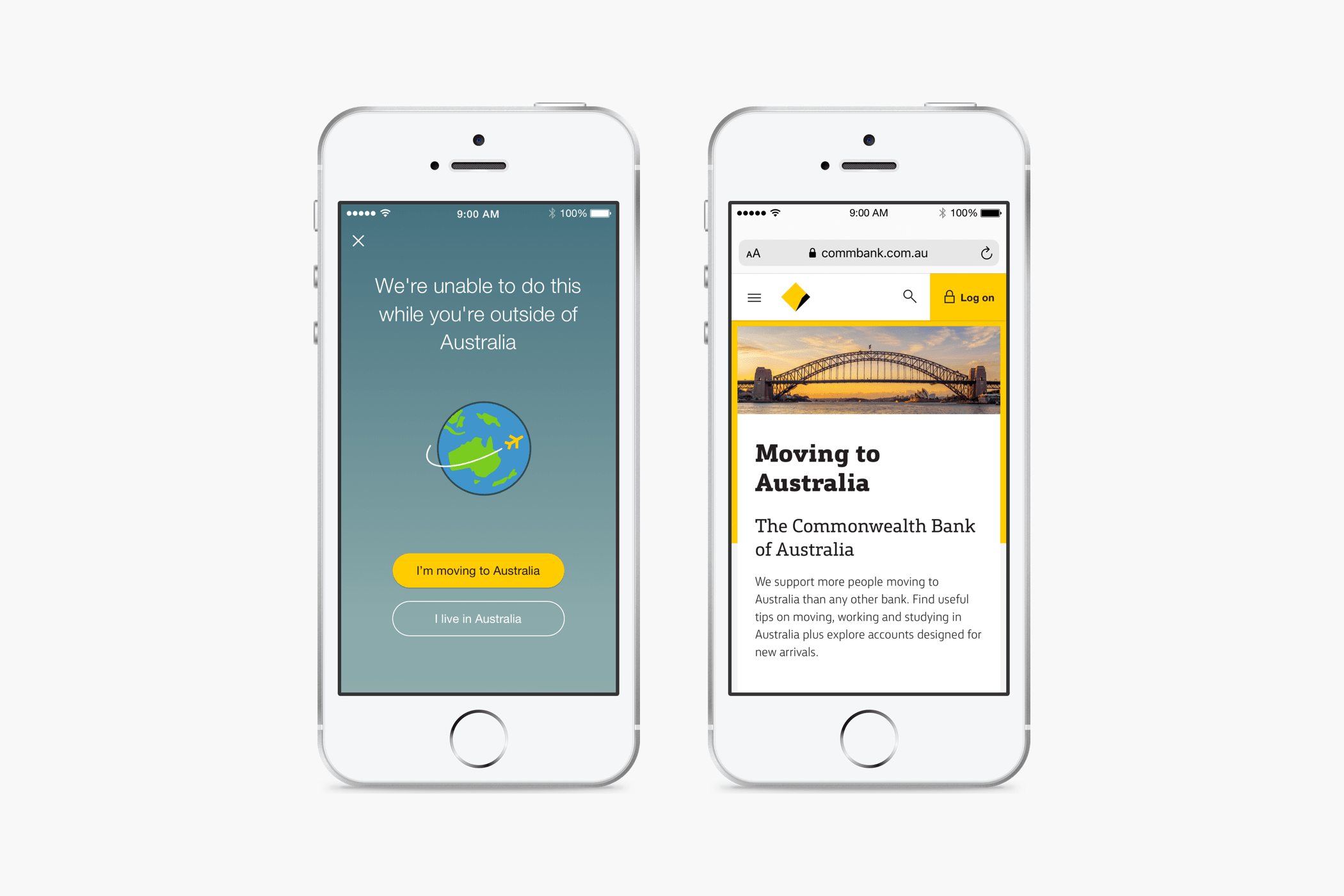

Sending overseas customers down the right path

Overseas customers can actually apply for a Commbank account while overseas, however this option is not available in the app. By detecting where customers were we were able to send them to the right path on the Commbank website where they can continue that process.

Following up to encourage those who have been slow to use their new account

I created a first time experience onboarding to encourage new users to interact with their account by giving them the opportunity to nickname the account, and providing options on how to fund the account.