Senior Product Designer | Intuit Australia | January 2021 - January 2022

Overview

I led the end-to-end design of a new BAS (Business Activity Statement) preparation workflow for QuickBooks Accountant in Australia. The project was aligned with Intuit’s 2021 strategic goals: to reduce the time accountants spend in-product by 25% and to grow market share in the Australian accounting segment.

We focused on micro-advisors — accounting and bookkeeping firms with four or fewer employees — who are typically software-agnostic but highly influential. They tend to recommend accounting platforms that streamline their own workflows, making them a critical segment for driving adoption among small business clients.

Discovery

To identify the most time-consuming tasks in micro-advisors’ workflows, I partnered with a UX researcher and product manager to conduct 12 discovery interviews with micro-advisors currently using QuickBooks.

Key pain points emerged:

BAS preparation

Sourcing documents from clients

Reconciling accounts

Fixing client errors

Lack of Quickbooks integration with lodgement tools

BAS preparation stood out — it was time-consuming (often taking over an hour per job), required significant manual effort, and had zero tolerance for errors due to compliance obligations.

To deepen our understanding of the BAS workflow, we conducted a second phase of research: nine unmoderated diary studies where we asked micro-advisors to record themselves completing a BAS job for a client using either QuickBooks, Xero, or MYOB. This was followed by in-depth interviews to unpack friction points and identify product gaps.

Insights

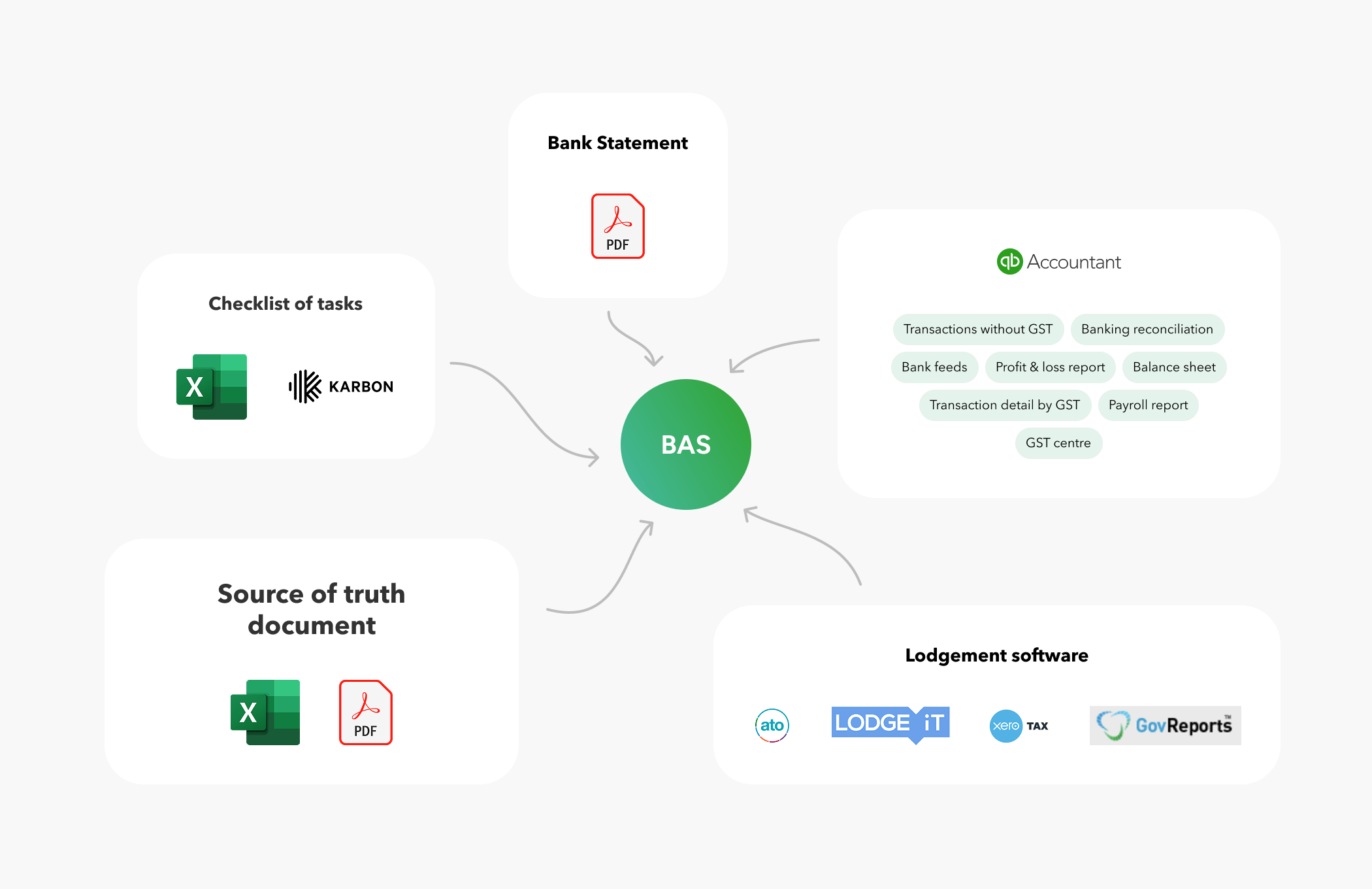

We learned that the BAS preparation journey is highly fragmented, requiring advisors to use multiple disconnected tools and systems to complete each job. This includes external platforms as well as switching between various features within QuickBooks itself, leading to inefficiencies, context switching, and a higher risk of errors.

The BAS Journey

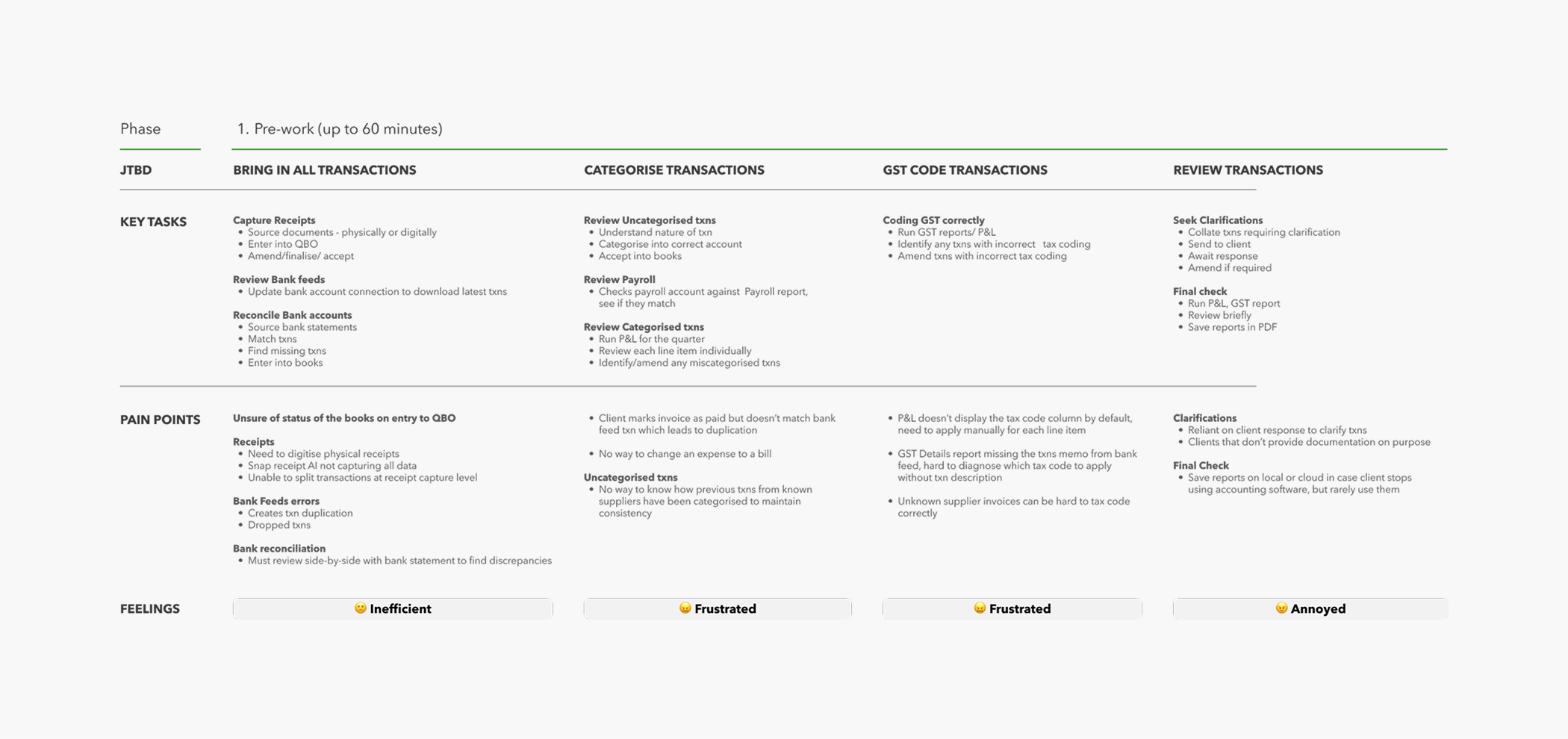

I mapped the end-to-end customer journey and identified four key stages: pre-work, preparation, lodgement, and reconciliation. The pre-work phase, which could take up to 60 minutes, had the most friction and manual effort—making it the clearest opportunity for improvement and impact.

Ideation

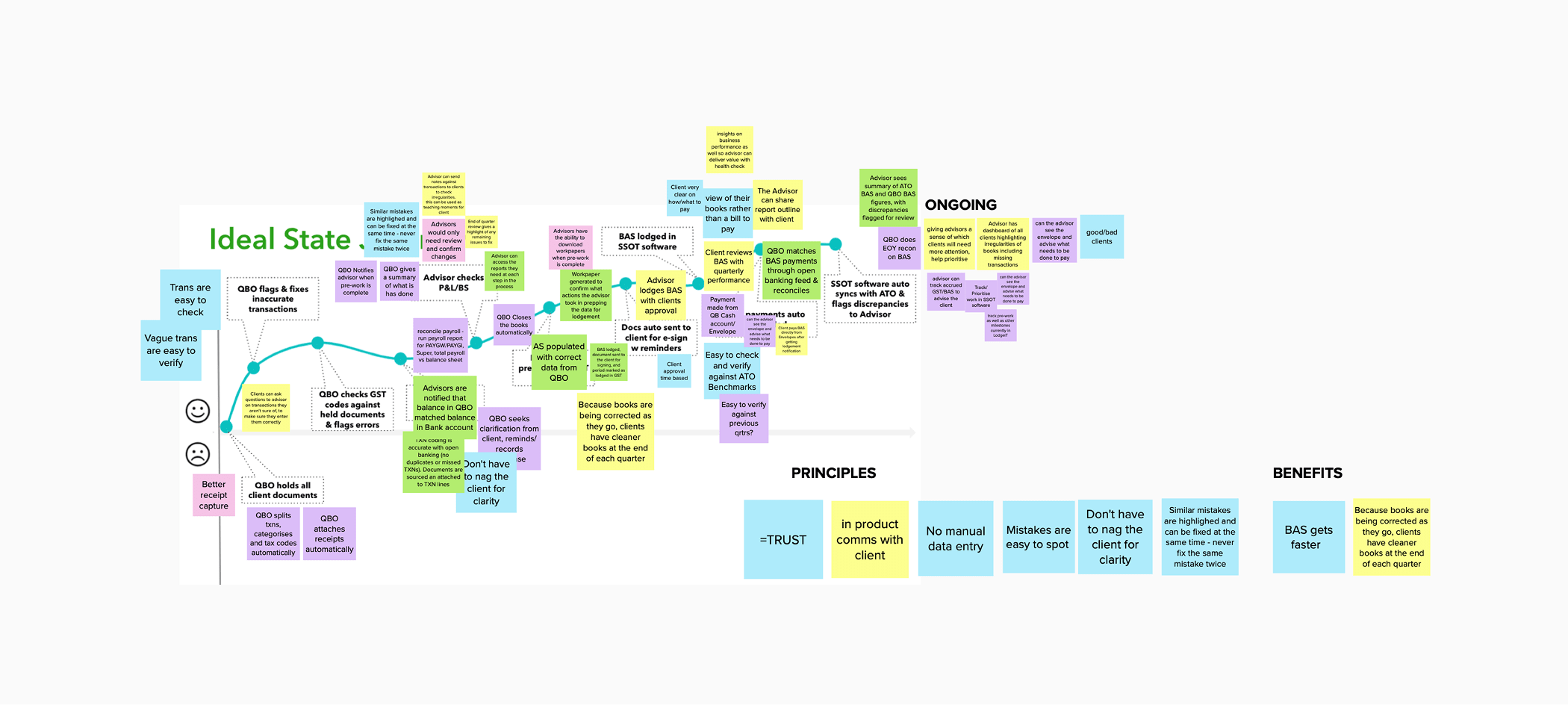

We decided to focus our solution on the pre-work phase. In collaboration with the PM and tech lead, I led a series of ideation workshops where we:

Identified opportunity areas from the pain points

Storyboarded the ideal BAS preparation experience

Created an opportunity solution tree to plan experiments

Sketched early concepts to test assumptions

Proof of concept

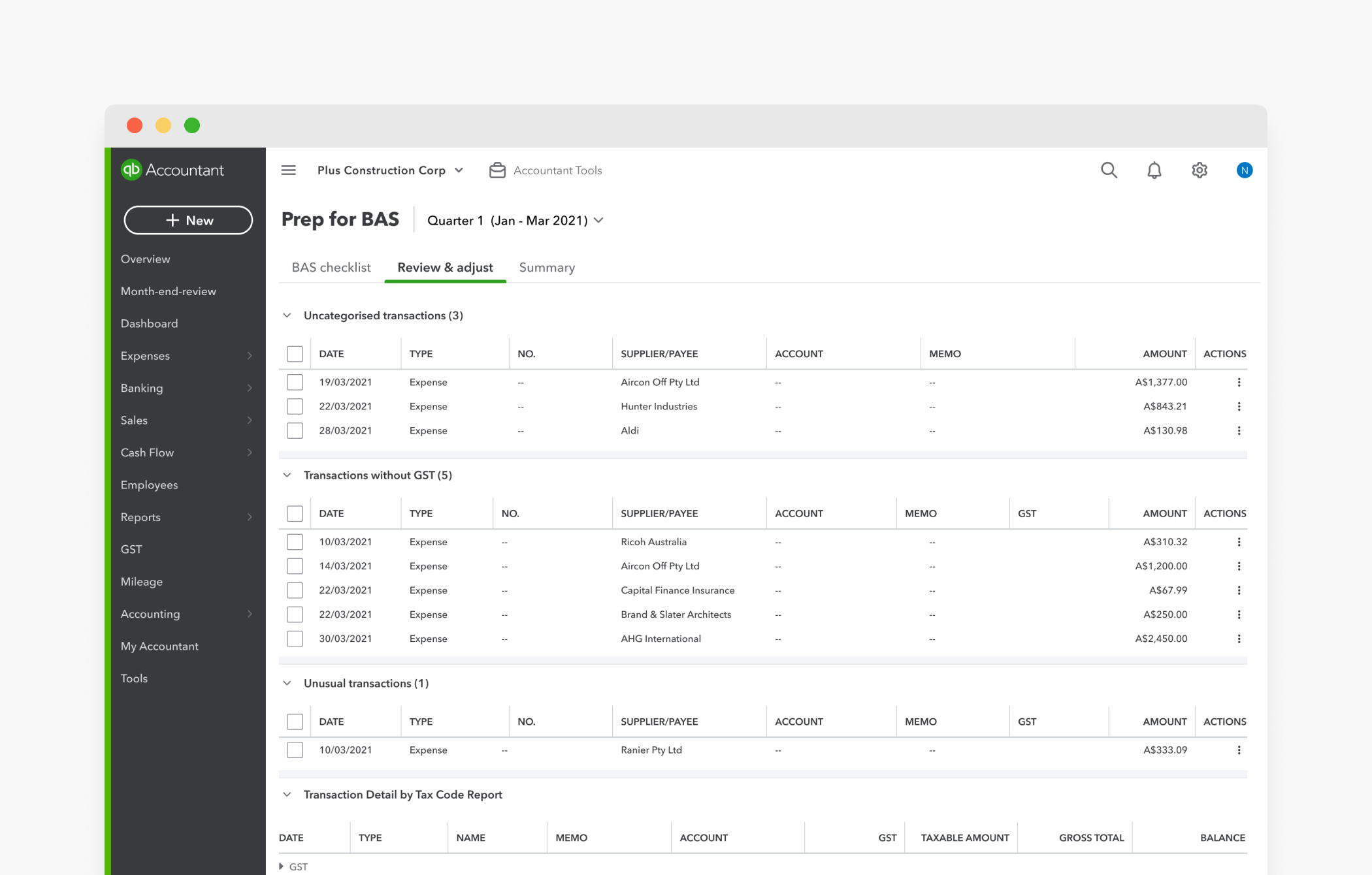

This led to the concept of Prep for BAS — a consolidated workflow within QuickBooks that would help advisors complete quarterly BAS work more efficiently and confidently, which included a customisable checklist pre-filled with common BAS tasks, a centralised review screen highlighting transactions needing attention, visibility of final BAS figures once pre-work was completed, and the ability to export data to LodgeiT for lodgement.

Concept testing

We tested the Prep for BAS concept with 10 micro-advisors

Results

8 out of 10 advisors said they would confidently use the feature, estimating it could save them around 30 minutes per BAS job. However, a key piece of feedback was that the workflow felt overwhelming and would benefit from being broken into smaller, more manageable steps.

Final Solution: Books Review

Based on feedback, we evolved the concept into a more modular, step-by-step experience: Books Review. While the Prep for BAS concept was initially designed around the quarterly BAS workflow, we learned that advisors would also use this tool for monthly clean-up—expanding its value beyond just compliance.

To refine and validate the solution, we ran additional in-product experiments, including a demand test and feature entry point testing.

We iterated extensively, conducting six rounds of usability testing while navigating significant technical challenges.

The development and rollout involved close collaboration with cross-functional teams across Australia, the UK, and the US.

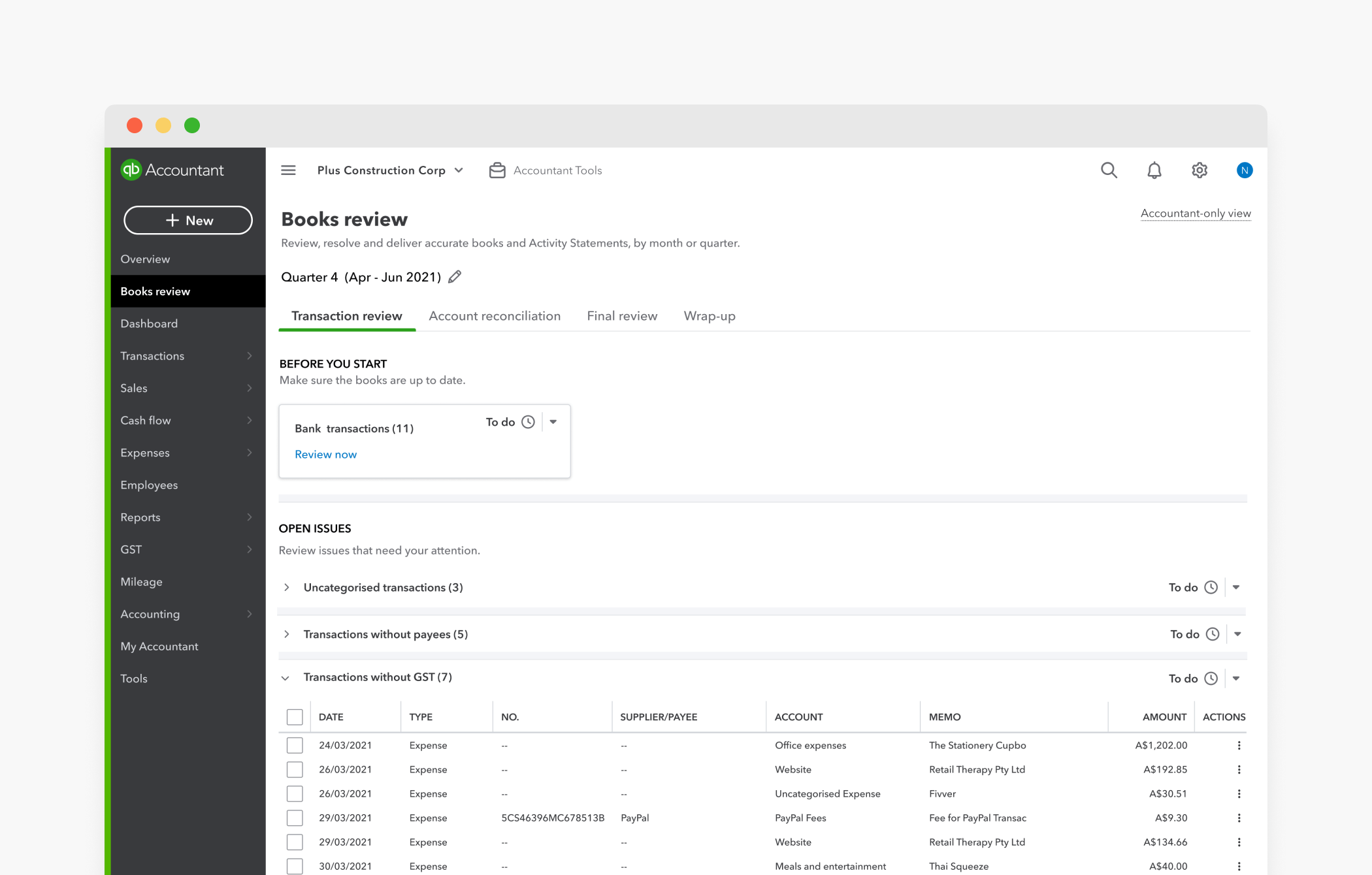

Transaction Review

The workflow surfaced transactions that needed review—such as those with missing or incorrect GST—and allowed advisors to make corrections directly within the experience, eliminating the need to jump between reports. It also included shortcuts to frequently referenced reports to support advisors who preferred to cross-check figures manually.

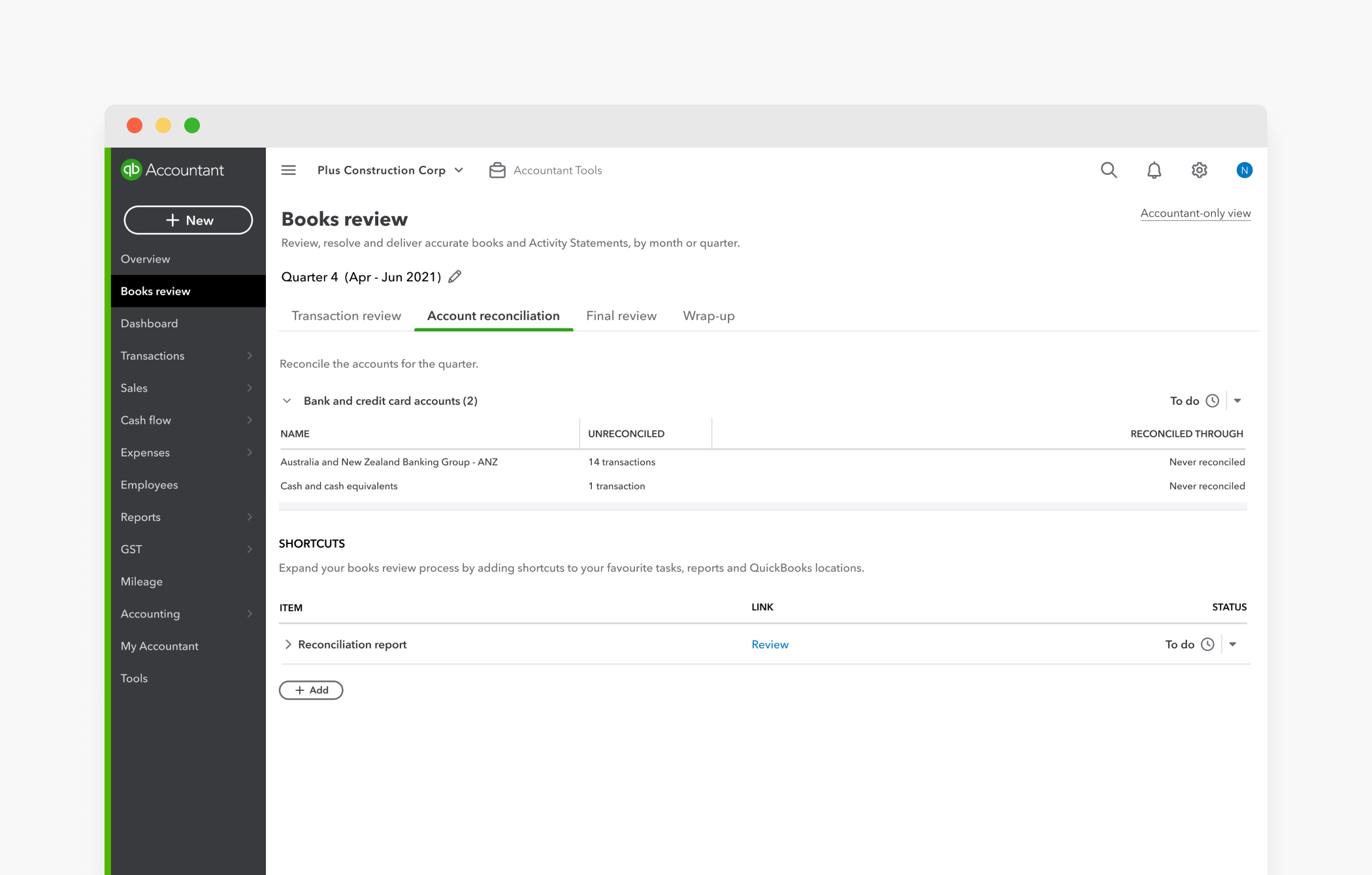

Account Reconciliation

Guided advisors to reconcile bank accounts once transaction issues had been resolved, ensuring accuracy before moving on to final review.

Final Review

Flagged any unexpected or unusual balances, prompting advisors to manually verify and address potential issues before completing the BAS workflow.

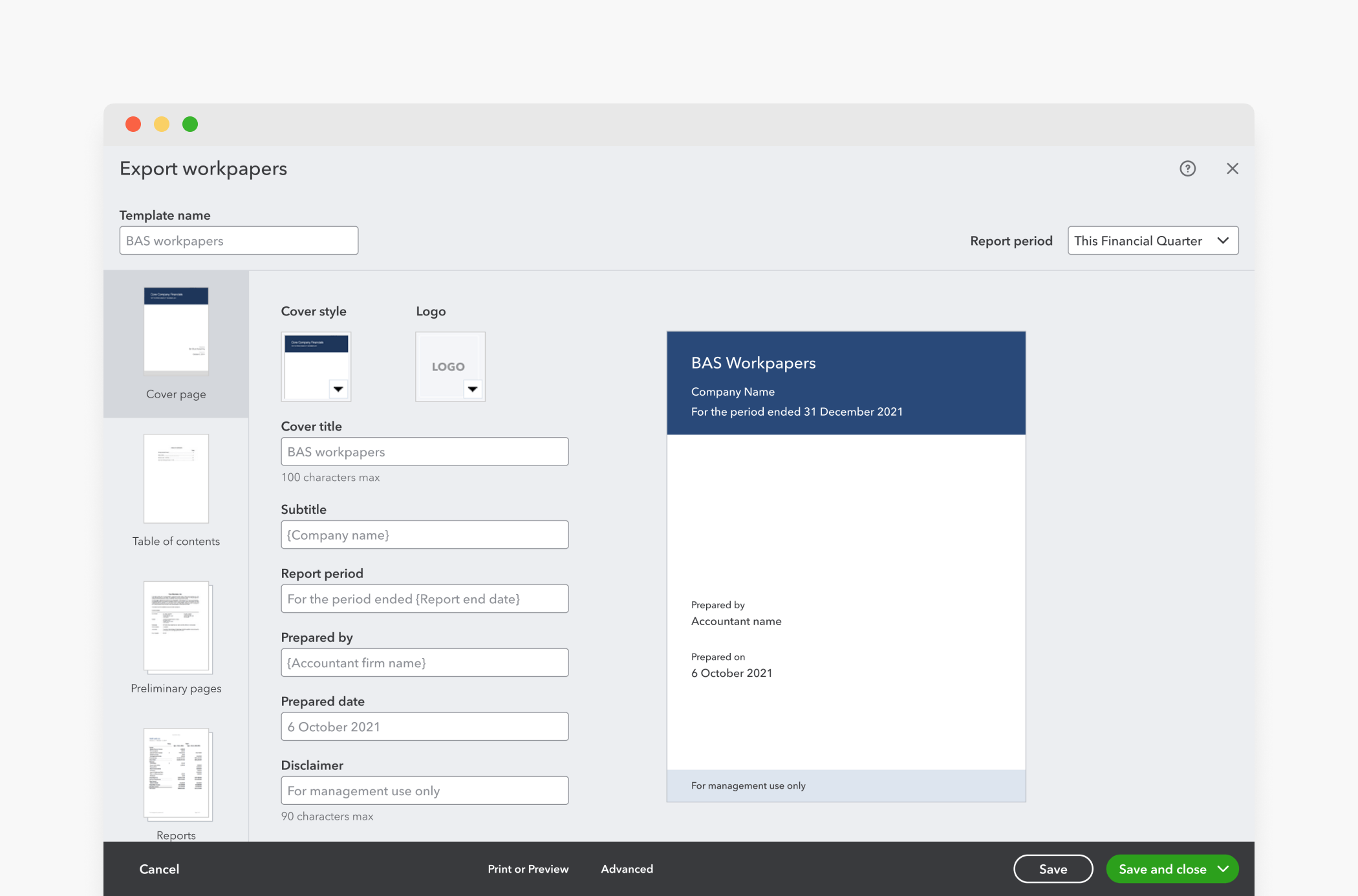

Wrap-Up

The final step included a checklist of tasks to wrap up the BAS cycle, along with the ability to export workpapers—allowing advisors to easily package reports into client-ready documentation.

Quantifying Efficiency Gains

To rigorously measure time savings, I designed a structured benchmark test with 6 micro-advisors:

Task: Identify and fix 7 transactions with incorrect GST codes

Test Design: Each participant completed the task in both the Books Review prototype and a live QuickBooks test account with the same data set

The order of testing was randomised to reduce bias

Results:

Current workflow: 10–12 minutes

Books Review: 2–3 minutes

Outcomes

1,391 unique advisors used Books Review within the first 60 days (vs. a 500-user initial target)

Adopted by 70% of the AU advisor base by mid-2022

Tax prep time reduced by 45% on average

Positioned as both a compliance tool and a monthly clean-up workflow